Where to start… You’ve probably come across a wide range of phone insurance options. So hopefully this article will help you pick the best one for you.

But before we get into our comparisons, is phone insurance even worth it?

Should I buy phone insurance?

A range of reports have found that nearly half of people damage their phones. Most people break their phone within the first year of owning it. The majority of damages result from accidental drops, leading to cracked screens, electronic or camera malfunctions, or water and liquid damage (lot’s of phones fall into tubs, showers, pools, hot tubs, and take toilet dives!) Also, just because your phone is advertised as “waterproof,” it may not be if it has sustained any prior damage resulting in even the smallest of cracks that can let liquid seep in.

Repairing phones today typically will cost hundreds of dollars. Screen replacements alone for something like a common crack range from $300 at the lower end and go up to $500 for new high-end phones like the iPhone 15 Pro and Samsung Note and Galaxy devices.

But for any damages beyond screen cracks, typically the entire device will require replacement! And a full replacement will cost nearly the entire price you paid for your phone when it was brand new, unless you want to downgrade to a cheaper model.

If you have one of the newest high-end flagship phones from Apple or Samsung, you may be needing to shell out up to $1,000 (for models like the iPhone 15 Pro, or Galaxy-Z-Fold5). A refurbished version or an older version from the same manufacturer would still run you $700 or more.

So as often as people drop and damage their phones… is a risk of a $700 – $1,000 one you’re willing to take?

If you’re typically careful with your phones, you may decide you don’t need any phone insurance and would be better off taking the risk of damage occurring and paying out-of-pocket for any of these expensive repairs or replacements you’ll need.

But chances are if you’re reading this, you’ve already decided you may not want to run the risk of having to spend so much in case you break your phone or it gets stolen…

Here we’ll break down the costs and differences between what’s available and also provide some guidance in finding the best option for you based on the extent of the coverage provided, what type of device you have, the costs of the phone insurance and protection plans, and their claim deductibles.

Who offers phone insurance?

1. Manufacturer Phone Insurance plans

There are phone insurance plans offered by the major phone manufacturers such as AppleCare+ for iPhones, Samsung’s Total Care for Samsung devices, and even Preferred Care for Google Pixel phones.

Buying your phone insurance from the manufacturer of your phone can be a good idea because you’ll know all repairs will be done with all the proper parts to keep your device performing as it should even after it’s been damaged.

However, the phone insurance plans offered by manufacturers usually aren’t the best value compared to other phone insurance options… They can also be more restrictive.

AppleCare+ limits you to only (2) claims per 1 year coverage period with $100 deductibles for damage, $150 deductibles for theft, and $30 for screen repairs, and also requires all repairs be done at an Apple Store. If you break your phone or it is stolen more than twice in a year, you’ll be out of luck on being covered, and if the closest Apple Store is far away from you, then you probably don’t want to be restricted to only going there for repairs. (See list of all Apple Stores here).

Samsung’s Total Care protection, is a better value and allows up to (3) claims in a 1 year period also with up to a $250 deductible for damage, and some lower deductibles for screen repairs. But the network of repair centers that service Samsung phones through this repair plan is quite limited so getting your phone fixed may take awhile longer, and waiting on parts to be in stock can also cause delays.

Google’s Preferred Care limits you to (2) claims per 1 year coverage period, so similar to AppleCare+, you’ll be out of luck if your phone breaks more than twice in a year. The deductible for damage is also higher, $150, and if you don’t live near one of their select repair locations, you have to mail your device in and have a replacement shipped to you.

2. Mobile Network Carrier Phone Insurance Plans

One of the most popular ways people buy phone insurance is through their cell phone carrier. What you may not realize is that of the major 4 cell phone carriers in the U.S., AT&T, Verizon, T-Mobile, and Sprint, all of their phone insurance plans are actually provided by the same insurance companies: Asurion and Assurant.

The upside to this is that Asurion and Assurant have a lot of experience with handling phone claims and because of the large volume of phone insurance plans they provide, they also offer pretty good pricing! However, depending which cell phone carrier you have… they may be trying to charge you more money on top of the cost of the Asurion or Assurant plan they offer under their own brand name.

Most cell phone carriers provide the phone insurance plans ranging from $9 to $18 per month per device. If you have a newer expensive phone like an iPhone 12, 13, or Samsung Galaxy S21, most carriers will charge $15 – 18 per month for coverage. Some carriers like AT&T and Verizon offer package plans where you can cover 3-4 phones together for a bit of a discount.

But the deductibles charged by these phone insurance options can range from $100 to $300. Deductibles will be cheaper for simple screen crack repairs, and much higher for more extensive damage, liquid submersion, or theft.

Yet the price they all advertise as their deductibles range from “as low as $29 to $49.” However, that low deductible is only for a screen repair which falls under certain conditions and only for certain devices. For example, the newest iPhone has a screen that is too expensive and the deductible is actually higher. Additionally, these lower advertised deductibles are not available for all phone screen damage claims, typically only those which can be serviced by those in Asurion or Assurant’s repair networks which may not be available in your area.

3. Retailer and Third Party Phone Insurance Plans

In addition to the phone insurance offered by the major U.S. cell phone network carriers, retailers like Best Buy offers phone insurance via Geek Squad, and third party insurance providers like Squaretrade, a part of Allstate, also offer a very popular phone insurance option. Walmart also sells phone insurance, and while it used to be provided by Asurion as well, they recently switched to providing Squaretrade coverage (a part of Allstate).

Best Buy’s Geek Squad Protection:

Costs $9-11 per month without theft coverage and $11-13 per month with theft coverage. But the deductibles for any repairs on a phone that’s worth $800 – $1,000 (which is most new iPhones and Samsung devices) is $200! For a theft claim, it’s $250. There’s also a limit of (3) claims within 2 years.

Squaretrade Phone Protection (same as Walmart):

Costs $9 per month and does not include theft coverage. Deductibles are $149 for any claim with some screen repairs costing less depending on the availability of select repair options in your area.

Can I buy phone insurance if my phone is more than 30 days old?

This means that if you purchased your phone awhile back, and now you’ve decided you’d like to buy phone insurance for it, you’ll have less options.

Squaretrade allows you to buy coverage on an older phone, but will obviously not cover any damage or problems with the phone that existed prior to when you purchased protection.

The better option though is phone insurance through an AKKO plan… (learn more below)

The Top Choice

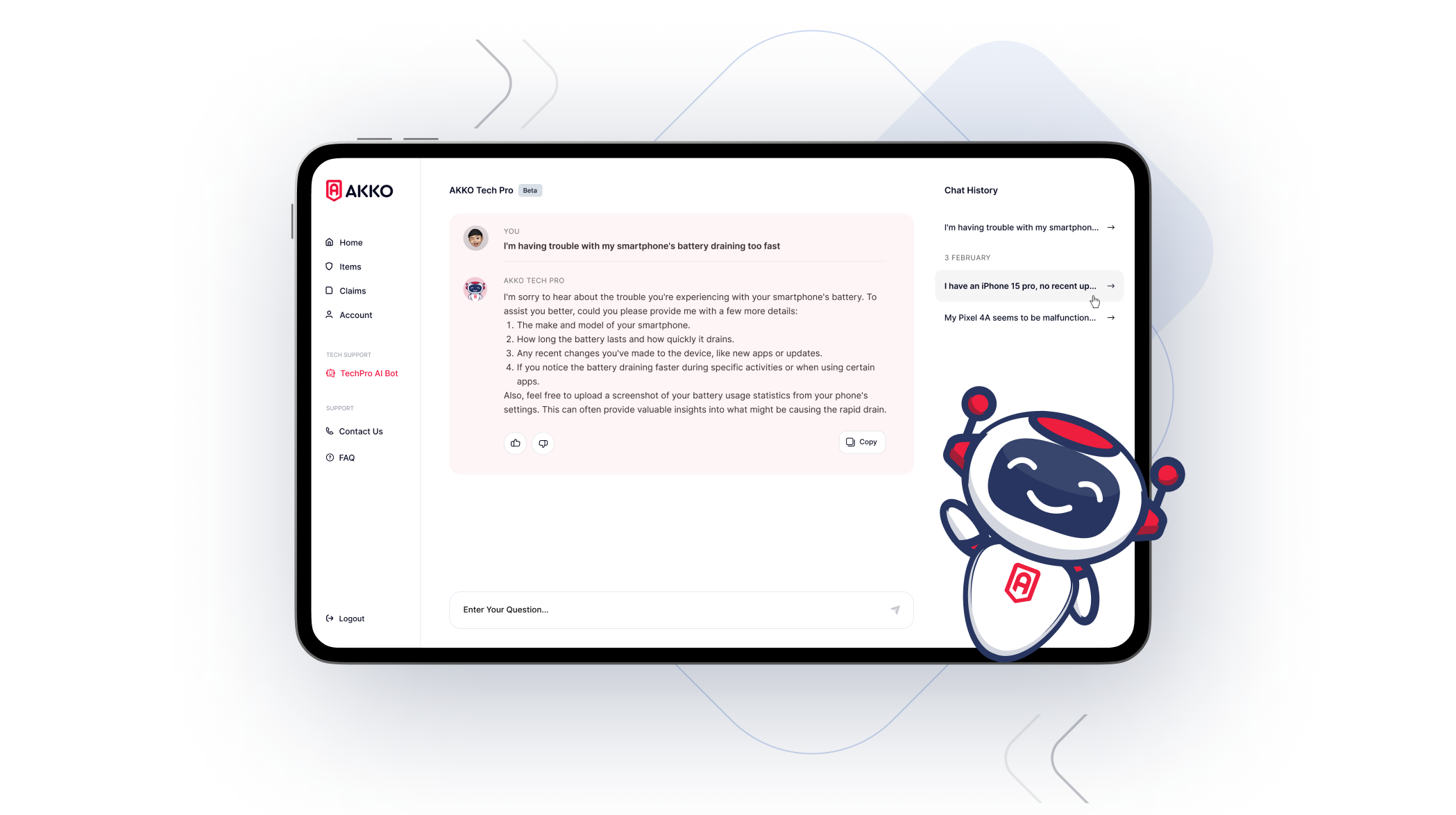

Best Phone Insurance in 2024: AKKO Plan

We’ve reviewed all the most popular options for Phone Insurance, but the choice becomes pretty clear when you compare them against an AKKO Plan. You can also view our comparison chart here. As well as read about why GadgetReview ranked AKKO #1 for Phone Insurance here and Android Central ranked AKKO Best Alternative Phone Insurance, the only 3rd party protection provider that made their list alongside SquareTrade.

AKKO has also been ranked #1 by Benzinga ahead of Squaretrade, AppleCare+, and Samsung Premium Care and the best cellphone insurance based on policy budget by Investopedia ahead of Asurion, Squaretrade, AppleCare+, Samsung Care+, and Progressive!

Cost:

~ Way better value. ~

While other phone insurance plans cost an average of $12-18 per month for a higher-end phone, an AKKO Plan costs $15 per month and protects not only your phone, but nearly ALL your personal electronics and personal items (such as laptops, tablets, headphones, and more). So if you’re comparing based on the cost of insurance, you won’t get a better value elsewhere, because all the other phone insurance options only cover 1 item: your phone! But an AKKO Plan covers your phone + nearly ALL your electronic devices and other personal belongings.

UPDATE: You can also now purchase AKKO’s Phone Protection plans starting from only $5 per month! (you can then always upgrade to an AKKO Plan later).

Coverage:

~ More protection, unlimited claims. ~

An AKKO Plan includes not only Accidental Damage protection, but also Theft protection and there is no limit on the number of claims you can file each year. This makes an AKKO Plan a far superior choice in protecting your phone because in case you do face multiple incidents of damage or theft, you won’t be stuck with a phone insurance plan that won’t protect you! You also get unlimited claims for all your other devices and personal items on your plan (laptop, tablet, headphones, smartwatch, TV, etc.)

Repairs:

~ Super flexible, repairs close to you. ~

What makes an AKKO Plan an even clearer top choice for phone insurance is the repair process. With an AKKO Plan, you can get your Phone and other Devices fixed just about anywhere you want. Most times you get to choose the closest and most convenient repair shop, and if you have an Apple device, you can get it fixed at an Apple Store! (including Apple computers, laptops, iPads, and watches).

Deductibles:

~ Lower than other plans, $29 for any iPhone screen crack, $29 – $99 for Androids, and no repair or theft deductibles higher than $99 for any phone or any other device. ~

With an AKKO Plan, the deductible for any iPhone screen crack is only $29, and $29-$99 for Androids based on the model. For any other claim deductibles are never higher than $99, whether Accidental Damage that requires more than just replacing your screen or a really bad drop that results in needing a full device replacement. This deductible is substantially lower than many other phone insurance providers. This same $99 deductible also applies to Theft claims (vs. up to $300 with any other plan that covers theft). For some older/lower-cost phone models, the deductibles are only $29-$75!

WAY MORE than just Phone Insurance (at no extra cost!):

~ Most customers call an AKKO Plan a “No Brainer.” ~

Not only does an AKKO Plan prove to be a superior phone insurance option, but for the same cost as phone insurance from say… T-Mobile or Sprint, or paying a couple dollars more than what you’d pay for AppleCare+, an AKKO Plan will provide you with the same Accidental Damage protection for your phone PLUS include Theft protection, AND extend the same Damage & Theft protection to nearly ALL your personal electronics and belongings!

You can choose to protect…

Electronics: Laptops, Tablets, Smartwatches, TVs, Speakers, Headphones (airpods), and more

Gaming Devices and Systems: Monitors, Game Consoles, Custom Desktops, Peripherals (mice, keyboards, controllers), and more

Cameras & Photography Equipment: Digital and Film cameras, GoPros, DSLRs, Lenses, Lights, Accessories, and more

Audio Equipment & Music Instruments: Speakers, Audio Gear, Microphones, Headphones, Guitars, and more

Sports & Camping Equipment: Bikes, Scooters, Skateboards, Snowboards, Skiis, Golf Clubs, Tennis Racquets, Football/Baseball Gear, Tents, Outdoor gear, and more

Clothes, Jewelry, & Accessories: Sunglasses, Watches, Jewelry, Purses, Jackets, Boots, Shoes, and more

Conclusion

Even if you weren’t sure you wanted to buy phone insurance at all… Maybe now that you’ve learned about the AKKO Plan, you’ve realized there’s a way cheaper and better way to protect your phone, while also getting all the added value of protection for nearly ALL your other personal belongings , whether electronic devices, cameras, music instruments, and more!

(and don’t forget, if you do just want to only protect your phone, you can enroll in a phone-only plan for as low as $5/mo)

The idea of paying $15 per month to protect only your phone might seem expensive, because in the course of a year, you may not even damage your phone…

But with an AKKO Plan, if your phone doesn’t get damaged or stolen, the $15 per month you pay is also providing you peace-of-mind that all the items you care about most and rely on everyday are also covered against damage and theft. And that’s definitely worth it!

So think about the items that are most important to you. Besides your phone and electronics, what other items would you add to your AKKO Plan?

Learn more about AKKO’s coverage below and sign up for a plan today!

You can also check out why GadgetReview ranked AKKO #1 for Phone Insurance in their article here and why Android Central ranked AKKO Best Alternative Phone Insurance, the only 3rd party protection provider that made their list alongside SquareTrade.

Receive your 1st Month of protection FOR ONLY $1.00 and cancel anytime with no fees. Just enter your email below!

AKKO Plan Info & FAQs