Whether you’re a professional photographer by trade or simply enjoy taking photographs with a high-quality camera as a hobby, you likely understand how expensive camera equipment can be.

Cameras themselves can cost thousands of dollars — not to mention the specialty lenses, tripods, memory cards, and other equipment that you might want. All in all, anyone who takes photography seriously can easily end up spending tens of thousands of dollars on their craft over the course of their career.

For most of life’s particularly expensive and valuable goods, like cars and homes, you can rely on insurance to reimburse you for damages or help cover repair and replacement costs when something goes wrong outside of your control. If you’re a professional photographer, your camera gear is your livelihood, making this equipment just as valuable to you as your home or your vehicle.

Did you know that avid photographers can access device protection for their camera equipment that’s just as supportive as other types of insurance?

Suppose that you have expensive, valuable camera gear that you want to protect against theft, loss, and accidental damage. In that case, you’ll be thrilled to hear that camera equipment insurance not only exists — it’s also extremely affordable and accessible to all!

What Is Camera Equipment Insurance?

Camera equipment insurance is exactly what it sounds like—specialty insurance designed to protect all different types of camera equipment used by professionals and amateurs alike.

Sometimes, the demands of professional-level photography can put photographers’ equipment at risk of damage or theft. Gadget insurance helps to make sure that photographers of all kinds won’t have to risk significant damage to their income should any crucial piece of equipment get stolen or damaged.

Does camera equipment insurance cover video equipment, as well? Yes! Photographers and videographers can benefit greatly from a high-quality gadget insurance plan.

Anything that you use for your photography or videography work can be included within your insurance plan as long as you claim it on the coverage.

Is Camera Equipment Covered By Homeowner’s Insurance?

In the age of digital cameras and video, photographers and videographers no longer have to work out of a darkroom or studio. They can complete most of their uploading and editing duties from home. Therefore, it might make sense to think that camera insurance would be included within a typical home insurance plan.

Unfortunately, not every homeowner’s insurance plan covers camera or videography gear. To find out whether your home insurance covers your equipment, you’ll have to contact your insurance company directly, as many companies maintain specific lists of items that can and cannot be included within a home insurance plan.

In some cases, expensive equipment such as camera gear can even be intentionally excluded from homeowner’s insurance policies by the companies that issue the policy.

How Much Does It Cost to Insure My Camera Equipment?

Though most equipment insurance policies are on the more expensive side, camera insurance plans don’t have to cost a lot of money.

Generally, your camera insurance plan will be added onto an existing insurance plan, such as your home insurance, renter’s insurance, or phone insurance, so you won’t have to worry about handling a separate bill each month.

Though the exact cost depends on the insurance provider and the details of your other insurance policies, most professional photographers and videographers can access high-quality camera coverage for just a few dollars per month.

What Is Covered Under Camera Insurance?

Is camera insurance worth it for your equipment? You’ll have to determine exactly which pieces of your equipment will be covered by your plan, how much your camera coverage will cost per month, and what your benefits would be should any piece of gear become stolen or damaged.

If you bundle your camera insurance with your home insurance plan, you may qualify for a comprehensive policy. Comprehensive coverage addresses a wide variety of issues, such as accidental damage, theft, and even loss.

However, you’ll have to determine exactly which scenarios your home insurance covers, as different insurance companies may consider certain situations to be the policy holder’s responsibility.

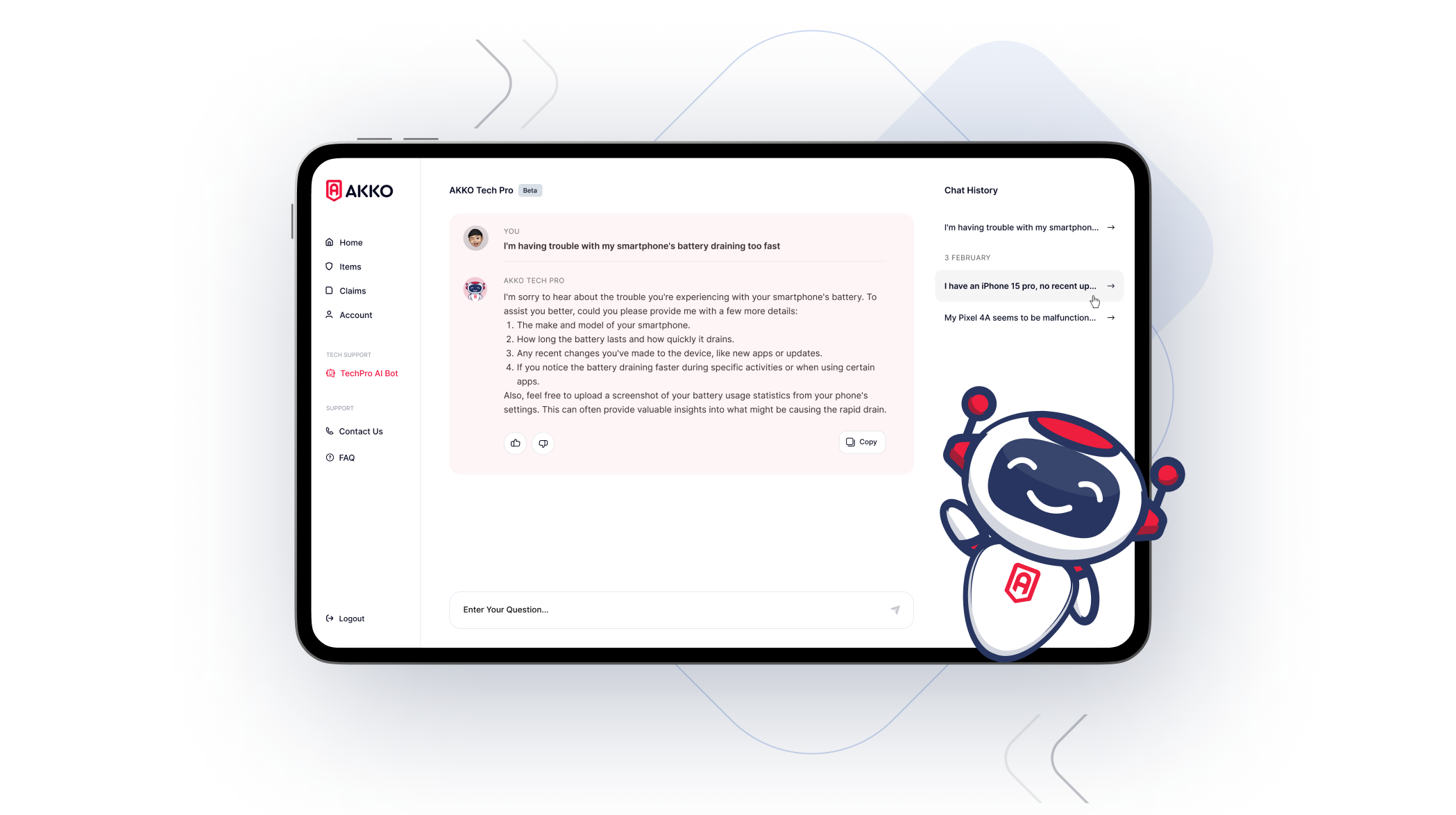

When you bundle your gadget insurance with a phone plan (like AKKO’s phone protection plans), you can enjoy high-quality cell phone insurance in addition to coverage for up to 25 personal items — which includes all types of camera and videography gear.

Best of all, you can rest assured, knowing that your valuable devices are covered in the event of a mechanical malfunction, all types of theft (including forced entry), accidental damage, and much more.

When Is It Worth Getting Insurance for My Camera Gear?

Many photographers ask, “Is camera insurance worth it?” Whether you’re a professional in your field or simply love taking pictures for fun, if you’ve made a point to invest in high-quality camera gear, you should insure that gear with a comprehensive camera insurance policy.

Accidental loss or theft of your gear could put you out thousands of dollars, but an insurance plan that costs just a few dollars per month could protect you from losing money on top of losing your precious equipment.

Though a high-quality photography insurance plan can save you money, time, and stress in the long run, it’s also important to keep certain safety measures in mind in order to avoid theft, loss, and accidental damage of your costly equipment.

You can protect yourself against these emergencies by installing a home security system, making sure to lock all doors and windows of your home and vehicles, and limiting the number of people that have access to your equipment or studio space.

Keeping track of your serial numbers will also be crucial in the event of a loss or theft. When you file a claim with your insurance provider, having your device’s serial number on hand will be a significant aid in the search for your item, while also assisting in the replacement or reimbursement process.

AKKO Family Gadget Plan

Whether you’re a professional photographer or videographer or not, you likely also have a smartphone that is valuable to you for work, leisure, and staying connected to family and friends. Therefore, we firmly believe that every moment spent without the AKKO “Everything Protected” plan is a moment wasted!

For just $15 per month, you can protect your new, used, or refurbished smartphone (as well as up to 25 personal items) from damage, internal mechanism failures, loss, and more.

Deductibles range from $29 to $100, which is much lower on average than similar plans found at companies such as AppleCare, Verizon, and Geek Squad.

Interested in gadget coverage for the whole family? AKKO’s family plans and bundles make it easy to combine insurance for multiple people on the same policy, saving money and making sure that every member of the family’s valuable belongings can be protected.

Plus, students save big at just $12 per month on average for full coverage of a device (and up to 25 belongings) compared to the standard monthly rate of $15.

Why AKKO Camera Insurance?

You may still be wondering, “Is camera insurance worth it?” We can firmly say that with an AKKO plan, it is.

If you were to seek coverage for your camera gear through your homeowner’s or renter’s insurance, any theft that you experienced would likely only be covered if you were at home at the time of the theft.

What’s more, many of these policies don’t cover accidental damage, which makes up a large portion of claims.

Even if you added device insurance to your renter’s or homeowner’s insurance, you would likely pay a deductible much higher than AKKO’s $100 deductible in the event of loss or theft of property.

With many of these insurance policies, your coverage costs will increase based on the number of claims you file, too. If you partner with AKKO, you’ll never see an increase in monthly fees based on claims filed.

When it comes to high-quality device protection at a fair rate, you can’t do much better than AKKO. Imagine the peace of mind you’ll get from knowing that your smartphone, camera equipment, and 20+ personal items are completely protected against theft, loss, and damage!

Effective Solutions to Protect Your Gear

In today’s connected world, many people list their electronic gadgets among their most valuable items. Since daily routines and even your livelihood can be seriously interrupted by theft, loss, or damage to these items, doesn’t it simply make sense to get them insured?

Whether you run a photography business and have a career to uphold or you simply value your expensive equipment too much to let it go unprotected, AKKO can help to give you the peace of mind you need with comprehensive gadget insurance that won’t break the bank.

With our “Everything Protected” plan, you can lock in full protection for your smartphone and camera equipment, while also getting the benefit of over 20 spots left to insure other personal items such as your laptop, audio equipment, gaming consoles, and much more.