Riding your bike is an excellent way to get some exercise, explore your city, or even travel to and from work or school without having to pay for a vehicle or public transit. However, even some of the most avid bikers may not be aware that you can insure your bike the same way you can insure any other expensive piece of equipment that you own.

Already ride your bike regularly or trying to get into biking as a hobby? Don’t be caught unawares by theft or accidental damage; make sure that you consider bike insurance in order to save money, time, and stress in the event of an unfortunate situation.

What Is Bicycle Insurance?

Much like many other types of item insurance, bicycle insurance is designed to protect bicycle owners from having to pay out of pocket to replace or repair their bikes should they have the need to do so.

By paying into your insurance plan in small increments each month, you can feel supported by your insurance company, knowing that you have a safety net when it comes to bicycle damage or theft.

How Does Bicycle Insurance Work?

The way that bicycle insurance works for you will depend on where you’re getting your insurance from. If you’re looking to insure your bike, you can generally either claim it on your existing homeowner’s or renter’s insurance or seek individual insurance for your bike alone.

Claiming your bike on your homeowner’s insurance is probably the most convenient way to go about insuring your item. With this approach, you can expect reimbursement in typical situations such as theft, vandalism, or damage incurred by a natural disaster.

Basically, whatever types of damage are covered in regards to the other personal items in your homeowner’s insurance policy will likely extend to your bike’s coverage, as well.

However, insurance coverage for your bike only goes so far within the context of a homeowner’s or renter’s insurance policy. These policies tend to have relatively low coverage limits, which means that reimbursements given by your insurance company could end up being significantly lower than the bike is worth, depending on the quality of the item.

How much the item is worth won’t generally make a difference to your homeowner’s insurance company; it all has to do with the terms of your policy. You could take the route of adding an endorsement to your renter’s or homeowner’s insurance policy in order to raise the coverage limits for your bike, but it may end up raising your premium costs and making your policy too expensive in comparison to the benefits you’d get.

Avid bikers that own a high-end road or mountain bike (valued at around $1,000 or more) or even multiple bicycles may want to consider standalone bicycle insurance that’s separate from all of their other insurance policies.

These policies will cover standard issues such as theft, damage from a natural disaster, and vandalism, as well as many other common problems, such as damage from crashes and loss in transit.

Things to Keep in Mind When Getting Bicycle Insurance

Even with a comprehensive insurance plan in place, there are a few things to remember as a responsible bicycle owner that your insurance provider will expect you to do. Some of these include:

- Notifying your insurance company of changes (new address, new bike, etc.)

- Expressing any pre-existing health conditions that may affect you as a rider upfront

- Securing your bike to the best of your ability

- Disclosing what the bike is used for

You may be thinking, “Why does it matter to the insurance company how and when I ride my bike?” It matters because many bicycle insurance companies do not cover clients that ride their bikes as a part of their jobs, as this would be included within their employer’s insurance policies.

However, riding your bike to and from work is generally covered by most bicycle insurance providers.

How Much Does It Cost to Insure a Bicycle?

The price of your bicycle insurance will heavily depend on how much your bike is worth. This can be affected by a variety of factors, including what kind of terrain it’s designed for, when it was purchased, any special features it has, and more.

However, for specialized bike insurance, most avid bikers will pay somewhere between $250 and $300 in total each year to protect their bikes from theft, accidental damage, and other issues.

It’s important to do your research and get quotes from multiple companies before you decide on which bicycle insurance provider to go with.

On average, high-quality bike insurance will usually start around $100 per year for a bike valued at approximately $1,000 and range as high as $300 each year for extremely high-value bicycles.

Is It Worth Getting Insurance for a Bicycle?

Now that you know a bit more about how much individual bicycle insurance can cost and the types of issues it can cover, it’s time to consider whether this type of insurance is right for you.

When you’re asking yourself this question, there are several factors to take into account. However, the first details to determine are how expensive your bicycle is and how often you use it.

How Expensive Is Your Bicycle?

If you own a high-end bicycle, it’s probably more important to make sure that it’s under an insurance policy, as an out-of-pocket repair or replacement could reach thousands of dollars. Plus, avid bikers are naturally at higher risk of bicycle theft, accidental loss, and other types of damage due to the fact that their bike is simply in use more often.

Therefore, you should consider the dollar value of your bike as well as the level of risk of theft or damage that it’s under on a daily basis before you begin paying for a specialized bicycle insurance policy.

Does Bicycle Insurance Cover Bicycle Equipment?

Most bicycle insurance policies – including both standalone bike insurance and homeowner’s or renter’s insurance – will cover bicycle equipment as well as the bike itself.

However, it’s important to make sure that your specific insurance provider covers the types of equipment you own, as the types of bike equipment you need will depend on what type of biking you usually do.

Additionally, homeowner or renters insurance policies may have some limitations on how much they’ll be able to reimburse when bike equipment is stolen or damaged.

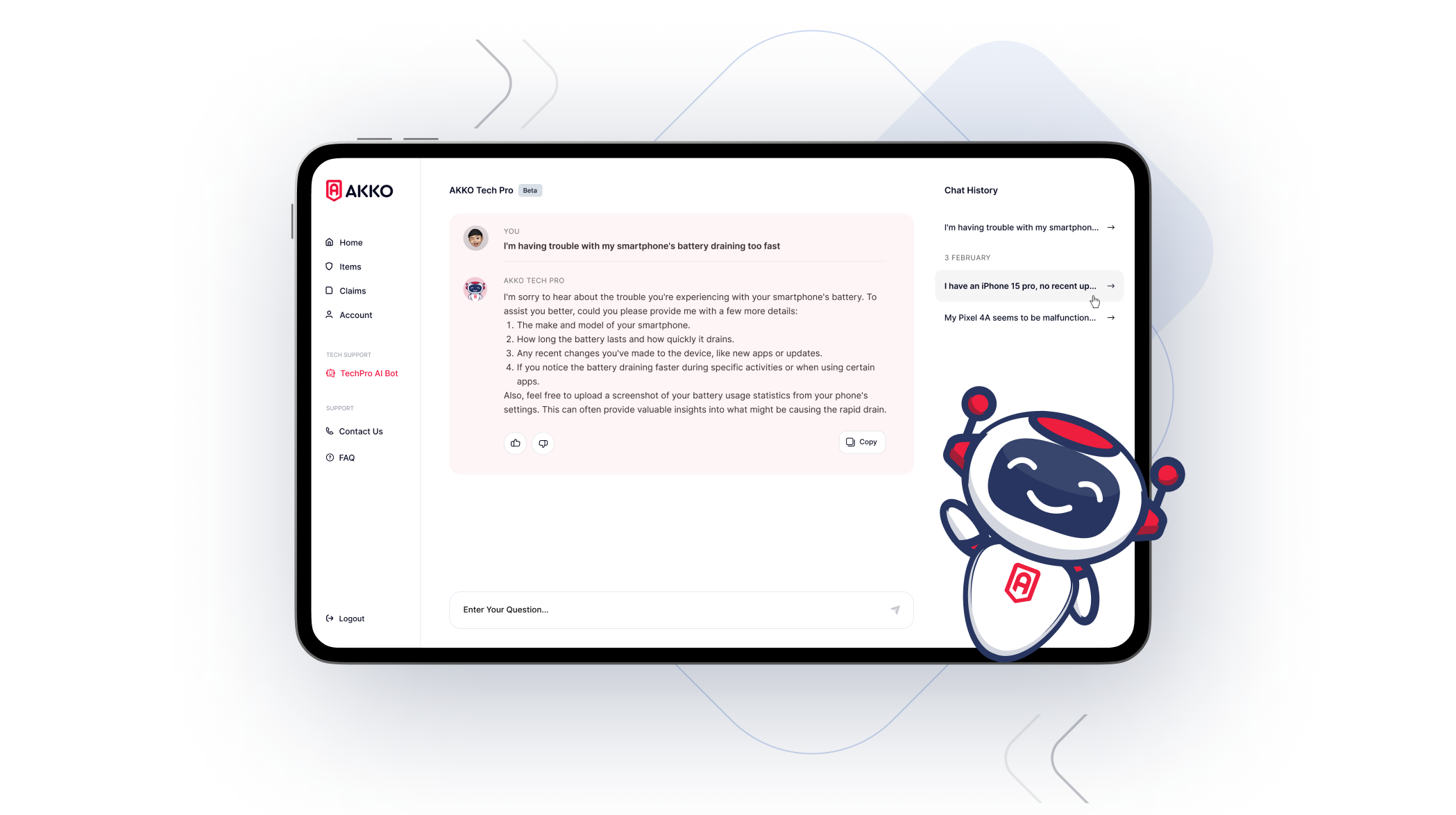

Cover Your Bicycle, Your Smartphone, and More with AKKO

If you’re constantly using your high-end bike, you’ll want to consider individualized bike insurance policies in order to avoid paying huge sums out of pocket after a bike accident or theft.

But what if your bike isn’t worth a ton, but you’d still like to protect it in the event of a similar emergency?

Even if your bike is worth well under $1,000, you still want to keep your trusty mode of transportation protected from theft, damage, and other issues as much as possible. Luckily, you can do just that and much more with AKKO gadget insurance.

We know what you’re thinking – what do phone protection plans have to do with insuring my bicycle? The answer is everything! These days, there are so many expensive and valuable gadgets that you rely on to get you from place to place, stay connected to friends and family, and complete your work assignments or schoolwork.

That’s why AKKO created the comprehensive “Everything Protected” plan that covers your smartphone, along with up to 25 additional items of your choice against theft, damage, loss, vandalism, and much more.

Our coverage includes items such as:

- Electronics like tablets, laptops, monitors, and smartwatches

- Music and audio equipment like speakers, headphones, and instruments

- Video and photography gear such as lenses, cameras, and tripods

- Video gaming consoles and controllers

- Personal modes of transportation like scooters, bikes, and skateboards

- Sports gear such as snowboards, skis, and tennis rackets

- School supplies like backpacks and textbooks

- And so much more!

Though the quality of coverage with AKKO individual and family plans is extensive and reliable, the best part by far is the price.

You’d think that with such a huge range of items covered within a single insurance plan, you’d be paying sky-high premiums and monthly fees. However, with AKKO, you can protect your smartphone and 25 of your most valuable items for just $15 per month – and our deductibles never exceed $99.

Protection Made Easy

Keeping all of your valuable items properly insured can be complex and stressful. Why not combine all of your most precious gadgets into a single comprehensive plan that boasts cheaper monthly costs and lower deductibles than many of the major providers – including AppleCare, Geek Squad, and Squaretrade?

Properly locking and storing your bike and maintaining it against elemental damage are excellent ways to avoid costly repairs and replacements. However, there are many issues such as theft and crash damage that simply can’t always be avoided.

That’s why it’s so important to protect your bike (and many other items) with AKKO insurance. Learn more on our website today!