Every Student Needs This...

Whether a freshman just starting an undergrad program or a graduate student in the midst of a grueling medical or law school course of study, students need protection, just like anybody else.

The problem is, most insurance coverage providers and protection plans don’t take into account the unique needs and concerns that students have – concerns that don’t often have an immediate or lasting impact on people outside of school.

For instance, what happens if your mobile device is broken or damaged? How about the theft of your belongings? Or damage from a flood or a fire?

Simply put, if a student finds themself in one of these situations and without any coverage, the impact of expensive repairs or the cost of replacement can be quite detrimental and the time taken away from studying or working while dealing with broken or stolen belongings can be even more harmful, especially for the items students depend on like their laptop, phone, textbooks, or bike.

Why AKKO is The Best

Other device protection plans, warranties, and property insurance policies miss addressing the needs of a student. Many may not cover occurences of Accidental Damage like drops, spills, cracked screens, and especially not Theft. But for the average College Student, these events are commonplace on campuses with bustling common areas with open public access, as well as in shared living spaces like on-campus dorms and off-campus apartments and houses.

What's Covered

An AKKO College Plan covers nearly all of a student’s belongings.* From electronics such as phones, laptops, TVs, headphones, and gaming consoles — to musical instruments, bicycles, scooters, snowboards, skateboards, sports gear, textbooks and school supplies—even shoes, sunglasses, and clothing—it’s all covered!

Full Protection against Accidental Damage, Vandalism, and Theft such as:

✔ Cracked screens

✔ Spills / liquid submersion

✔ Drops and damage/malfunctions from drops

✔ Vandalism

✔ Theft (pickpocket, robbery, break-in)

✔ Theft from any unattended vehicle

Why you should have AKKO in addition to renters and auto insurance:

Renter’s insurance works for covering bigger stuff, like a flood or fire. But, these policies require larger deductibles—anywhere from $250 – $1,000 per incident. Because of this, a renter’s insurance policy often doesn’t make sense for students who face far more common incidents like a cracked phone screen, a damaged laptop, broken sunglasses or headphones, or a stolen bike.

AKKO’s deductible is only $50, for incidents of damage or theft, meaning any student can afford to file a claim when something goes wrong, only pay $50, and get their stuff fixed or replaced and on with their studies and life. The AKKO College Plan also includes coverage for damage from floods, fires, and break-ins! So in many cases, a student may not even need a renter’s insurance policy if they have AKKO.

Vehicle insurance is also already high enough when you’re a student, and even auto-theft coverage doesn’t actually give protection for the items that are inside a student’s car – only the car itself. So, if your car is broken into— or even if your stuff is stolen out of your friend’s car—you are covered with AKKO.

Who We Are + Why we do it

AKKO was created by students, for students. As recent college students ourselves, we identified needs that other insurance companies and property protection plans just couldn’t address and decided there was nobody better to provide a solution than us.

The result? An extremely affordable, useful, and simple property coverage plan that is especially for college and graduate students.

Sign up today for only $14/month and choose any 25 items you specify to add to your AKKO account. The cost of your coverage also won’t increase due to filing claims, and there’s no limit on the number of claims you can file each year (unlike many other popular protection plans like AppleCare or Squaretrade).

Additionally, we contribute a portion of the proceeds from every new sign-up to our cause of providing underserved students with college assistance and opportunities.

To Sum Up:

AKKO offers the most affordable student coverage for real-world common incidents like drops, spills, and theft, the lowest deductible available from any property protection plan ($50 for any claim), and the opportunity to help other U.S. students who are less fortunate.

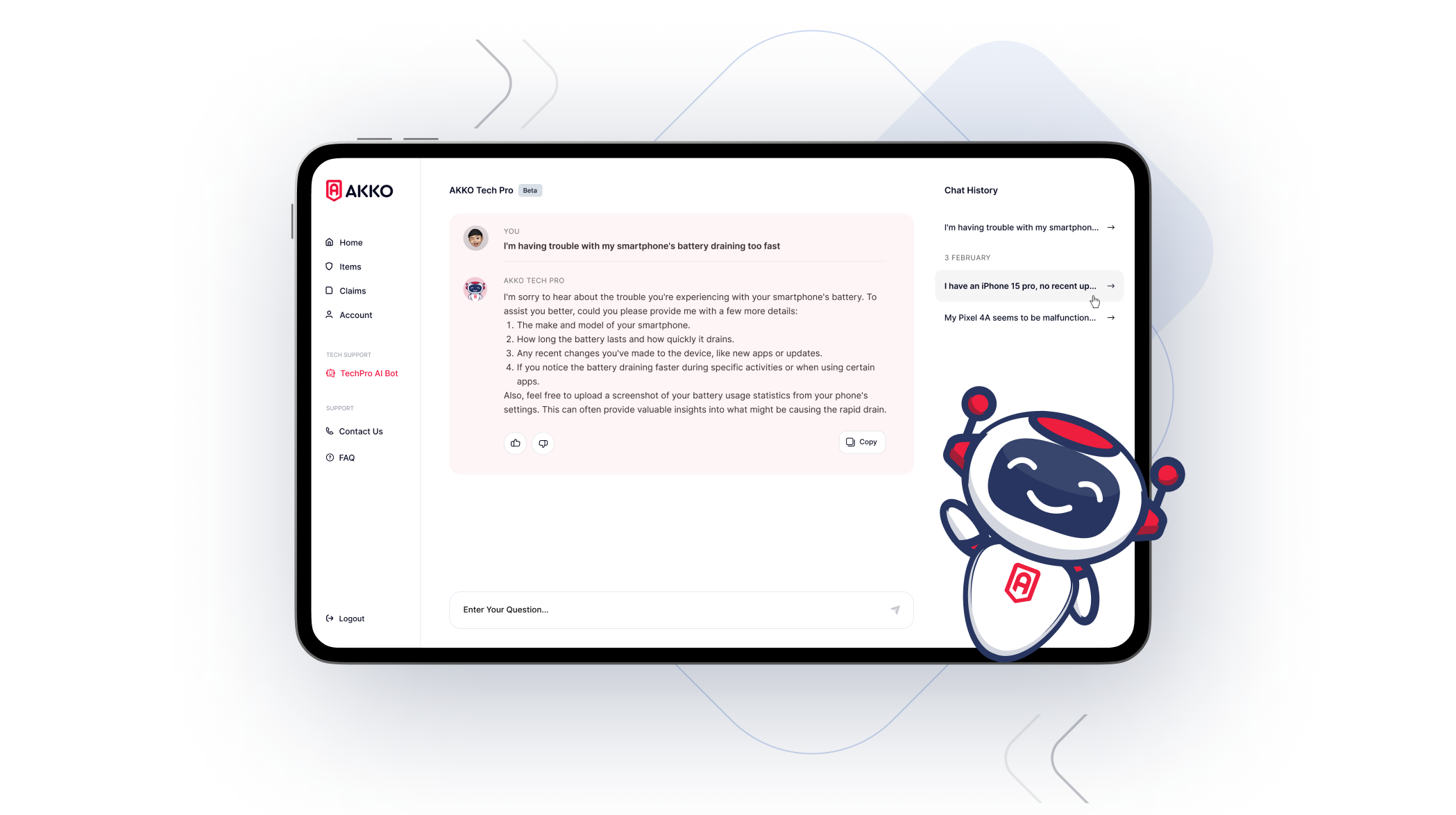

Add to that a founding team of recent graduates with a focus on students’ needs, top-notch customer service, simplicity, affordability, and a convenient web-app platform to manage the items on your account and view your plan details, and you’ve got the complete package.

All with the backing of one of the largest U.S. “A” Rated insurance companies.