“I’ve never had an easier repair for any product, cell phone etc. AKKO responded very quickly, send in the information and pictures needed, and just as simple as that my cell phone dilemmas where gone. Thanks. Appreciate you.”

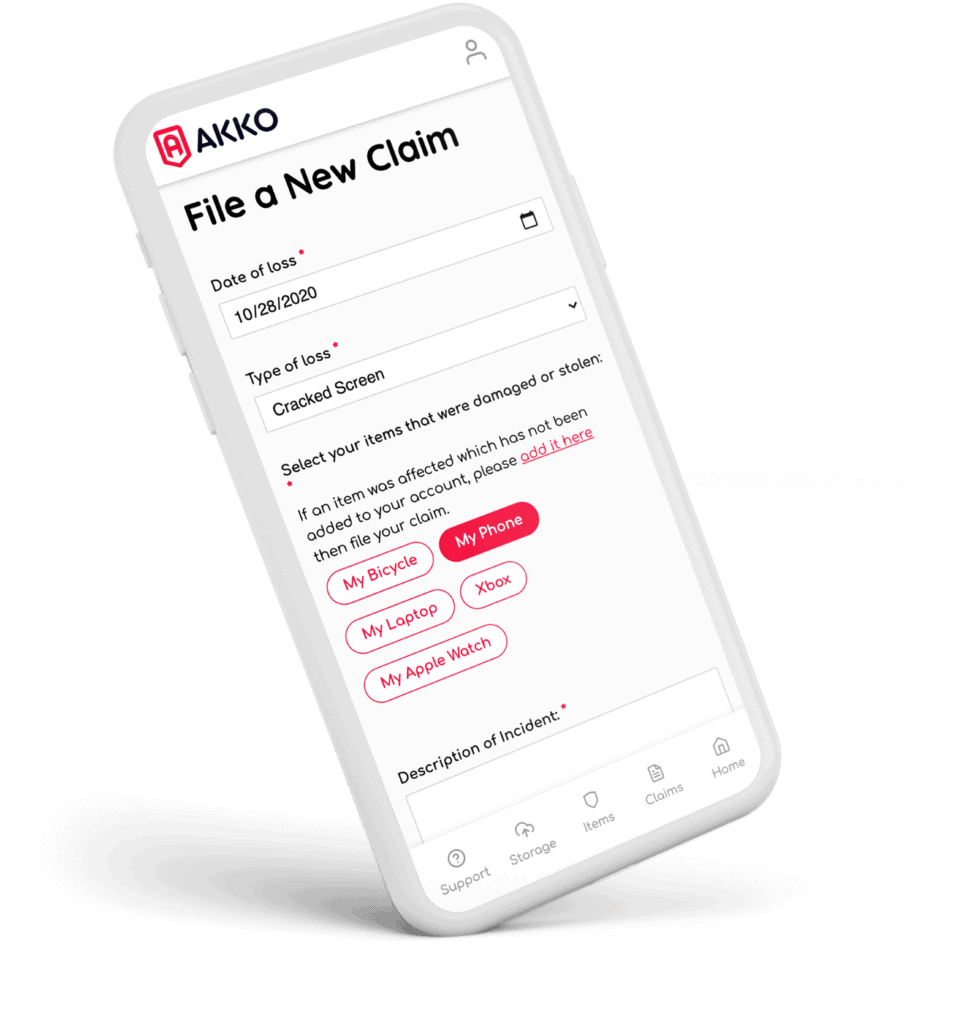

If you’re a shop that provides repairs and are not yet an approved AKKO Repair Partner, follow the steps below:

2- Click here to schedule a call with our Repair Partner Coordinator to get approved. (you must be registered on the AKKO Partner Platform first)

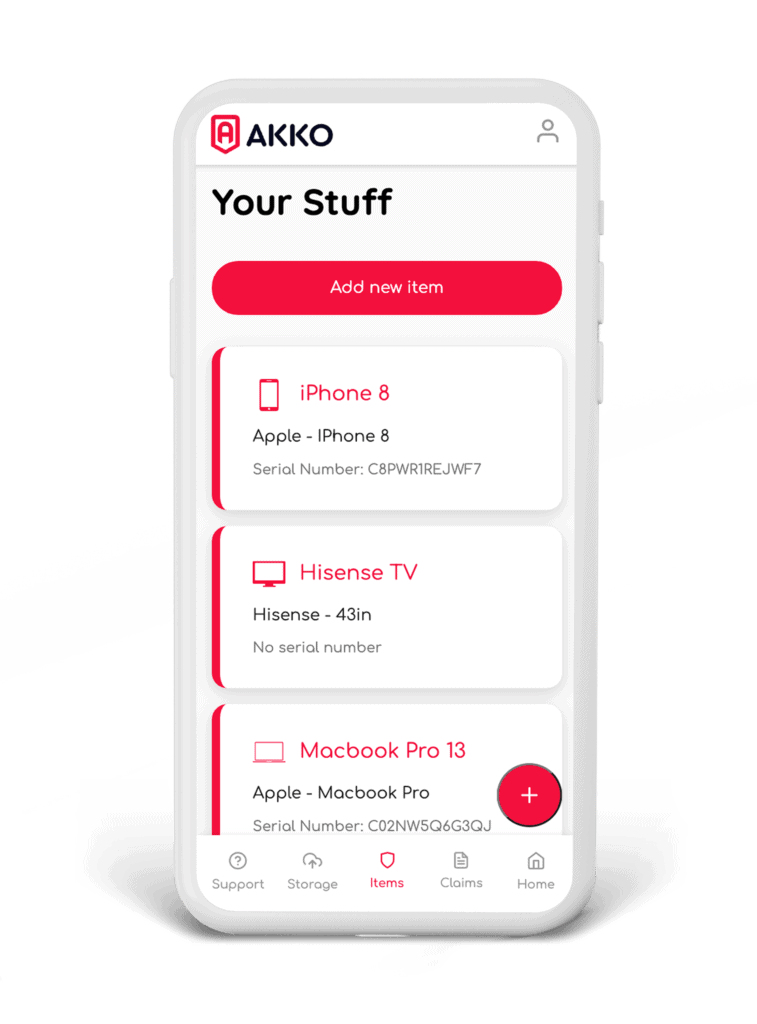

Once a partner has been approved to be an AKKO Repair Partner, any claims filed by users that the partner helped register get referred back to the partner.

In addition to customers a partner helps register getting referred back to them for claims, we will also refer our own customers that have signed up with us directly to approved repair partners that are near the customer.