Your television is one of your most valuable investments, providing you and your family access to entertainment, gaming, and the latest news. TV insurance protects this investment from mechanical or electrical breakdown, allowing you to keep streaming your favorite programs worry-free.

Many people assume that they’ll be covered by a manufacturer’s warranty or homeowner’s insurance policy, but television insurance goes beyond these policies, which is why it’s important to consider the advantages offered by a comprehensive TV insurance plan.

What Is TV Insurance?

When you purchase a new television from an electronics retailer, you’ll usually be offered some type of extended warranty. Retailers love offering these coverage plans, but for the consumer, they can be expensive, confusing, and limited in terms of the kinds of damage they’ll cover.

TV insurance eliminates the need to spend money on a complicated series of extended warranties and insurance add-ons. Instead, you’ll have a simple, all-inclusive policy that protects your television from theft, damage, or catastrophic failure.

However, you should beware. Not every TV protection plan is created equal. That’s why it’s important to understand the details of these policies and choose the provider that can offer you the greatest peace of mind for your valuable investments.

What Does TV Insurance Cover?

Every insurance provider is different, which is why AKKO is trying to simplify this process by offering a broad range of insurance coverage.

What does AKKO’s plan cover? Our TV insurance will protect you from:

- Theft (from your home)

- Theft (from forced-entry car break-ins)

- Cracked/damaged screens

- Broken buttons

- Blown speakers

- Damage to wires or power supply

- Accidental damage

- Spills

Typically, a manufacturer’s warranty plan won’t cover this kind of wear and tear and will only offer repair or replacement within a narrow time frame or for certain kinds of damage. Our protection plan offers coverage for a wider range of circumstances, giving you confidence that your electronic investments are well cared for.

Does It Cover Accidental Damage?

Yes! AKKO’s TV protection plan provides accidental damage coverage, covering damage caused by drops and spills. This coverage is a big deal since most manufacturer warranties don’t cover accidental damage, nor do the extended warranties offered by today’s top retailers.

For example, comparing AKKO vs. Geek Squad shows that AKKO’s protection plan covers more and costs less.

Accidental damage happens more often than you might think. Consider the following ways your TV might get damaged:

- You drop it while moving

- Your wall mount breaks

- The family pet knocks the TV over

- A frustrated gamer throws their remote at the screen

- You’re watering a nearby plant, and water leaks into your entertainment center

These kinds of incidents go a bit further than the usual wear and tear. If you have children, roommates, or just a lot of houseguests, the possibility of accidental damage increases dramatically. When the worst happens, you’ll be thankful you invested money in a TV insurance policy.

How Does It Work?

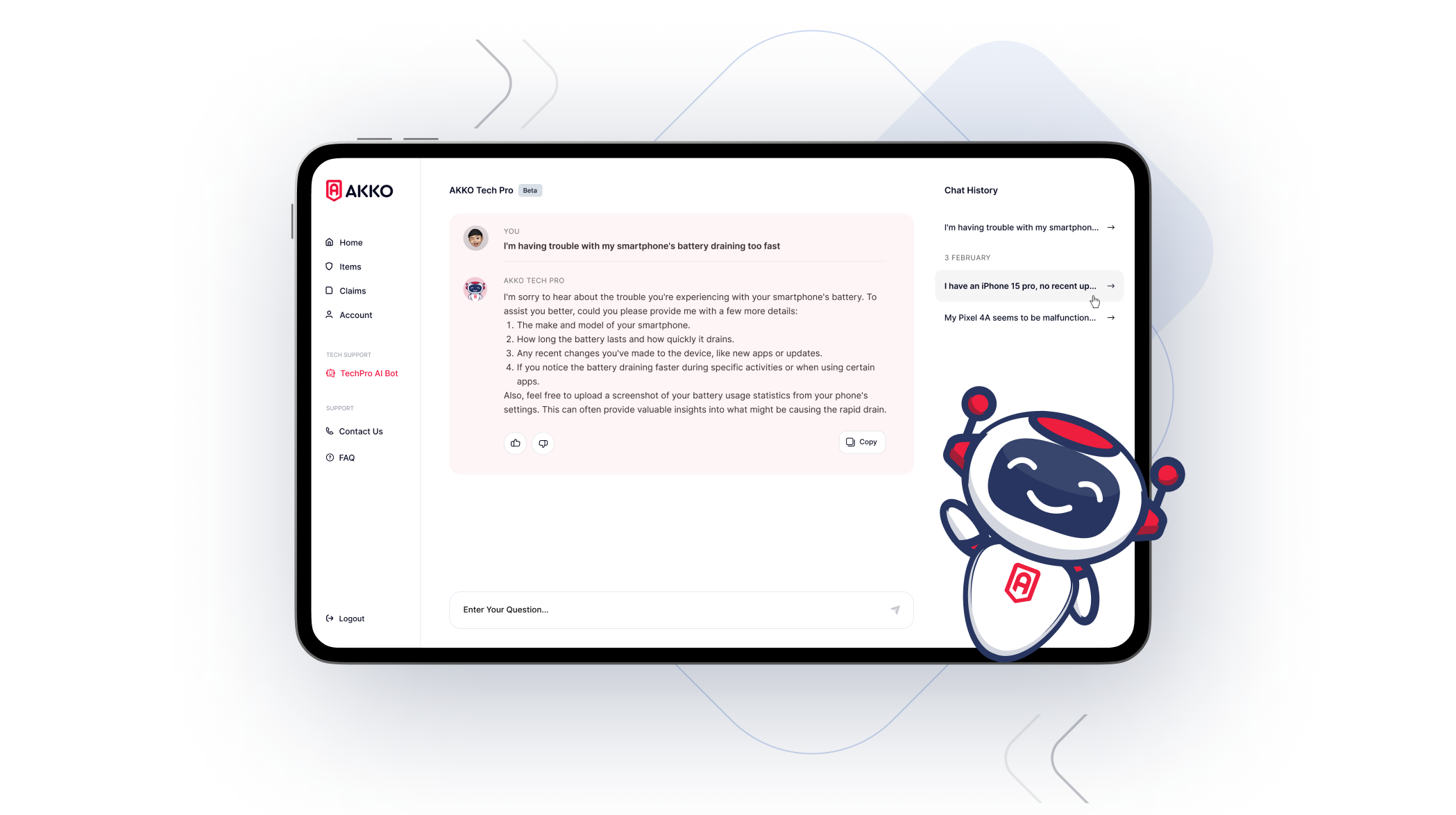

The AKKO plan provides you with one of our signature phone protection plans, as well as coverage for up to 25 additional items. These items can include anything from stereos to laptop computers, and yes, we also provide insurance coverage for television sets of all makes and models.

Your insurance coverage lasts for 36 months, starting from the date you originally purchased the device. Basically, you’re getting a three-year protection plan for your television and other electronic devices.

Proof of ownership will be required for all insurance claims, and proof of purchase will be required for all theft claims. This requirement will ensure that you receive the coverage you need for your television, and it will also streamline the claims process.

Filing a claim is simple. If your TV is damaged or stolen, simply log onto your AKKO account to file a claim.

After we receive your claim, one of our team members will reach out to you. In some cases, we’ll ask for additional information or direct you to a nearby repair provider. Some repair providers even offer home service to assist with a damaged item.

If your TV needs repair, AKKO can pay you directly on the same day that your claim is approved, using a service such as PayPal, Zelle, or a wire transfer. AKKO can also pay the repair provider or shop directly, as we have solid relationships with many repair providers across the nation.

Should your TV be beyond repair, we’ll cover the cost of replacement. AKKO will send you the replacement value equal to the cost of a refurbished television of the same make and model. In some cases, we may be able to send you a replacement item.

Customarily, there is a 30-day waiting period for lost, stolen, or damaged phones. However, we can waive this period when customers provide us photographic documentation of their electronics, including the damage itself and the serial number of their television or electronic device.

Sounds great, right? Understandably, you have some additional questions. Here are answers to some of the most common questions we receive about TV insurance:

Can You Buy TV Insurance After Purchase?

Yes! AKKO allows users to purchase a protection plan on all televisions and electronics purchased “new” within 120 days before their plan. That means if you purchase a new television, you’ll have roughly four months to purchase TV insurance.

Of course, we ask that all items be undamaged at the time that you purchase an insurance policy. Sorry, but you can’t purchase TV insurance after an accident has already happened, which is why it’s better to purchase a policy as soon as possible.

How Much Does TV Insurance Cost?

AKKO offers an “Everything Protected” plan that only costs $15.00 per month. If you pay annually, the monthly cost is reduced to $14.00. Students receive a discount, paying only $12.00 per month or only $10.00 per month if paying annually.

We also offer family plans for every member of your household, so even your college students can take advantage of the protection we offer.

For that price, you’ll receive protection for your phone as well as 25 other electronic devices, including your television. That makes AKKO’s protection plan a much better value than that offered by our competitors, who often charge you for each device you add to your policy.

Our lower cost can also be seen in our deductibles. For damage or theft, your deductible is only $99, and students only pay $49. Compare AKKO vs. SquareTrade, and you’ll see that SquareTrade deductibles can be as high as $299!

This cost is comprehensive, and you can receive a payout as high as $2,000 per incident, which means you’ll never have to worry about coverage for your valuable electronics.

Is It Worth Getting Insurance on a TV?

When it comes to insurance, it’s always better to have it and not need it than need it and not have it. The average 40-inch LCD TV can be as much as $500, and some larger screens and smart TVs can climb into the thousands.

That’s a high replacement cost, especially considering most manufacturers won’t cover damage caused by accidents or drops. With TV insurance, you’ll rest easy knowing that your investment is protected from all forms of damage.

Is It Worth It to Repair a TV?

Admittedly, it’s not always worth it to repair a TV. There was a day when you could flip through the yellow pages and find a local TV repairman, but those days are long gone. The specialized components of modern televisions are highly sensitive and costly.

With that being said, some specialized electronics repair providers are still available, and a TV insurance policy can pay for the cost of repair. If the service professional determines that it would be better to replace the television, AKKO will reimburse you for replacement in the amount equal to a refurbished model.

Does Homeowners Insurance Include TV Insurance?

Many homeowners dismiss the idea of TV insurance, believing that their existing insurance will protect them in the event of loss or damage. After all, won’t owner’s or renter’s insurance cover you for the valuables in your home?

The answer is yes and no. On the one hand, this insurance will cover a TV that is damaged due to fire, a lightning strike, a break-in, or a burst pipe. But your policy typically won’t cover accidental drops, floods, or normal wear and tear.

For specific terms and conditions, you can contact your insurance provider, but typically you won’t receive the full range of coverage offered by AKKO. This lack of coverage is why it’s wise to invest in specialized electronics insurance so that your devices receive the coverage you need without a lot of fine print.

The Coverage You Need — The Peace of Mind You Want

Sign up today, and you’ll see why AKKO has been consistently rated as one of the most reliable insurance providers on the market today. Our “everything covered” plan offers protection for a range of devices, so you’ll be thankful for the level of protection you receive from your policy.