If you’ve ever wanted to develop a musical skill such as playing an instrument, composing pieces, or producing music, you’re likely aware that developing your skill can require some investments. Depending on the type of instrument or musical hardware, even amateur musicians can end up spending hundreds of dollars on their hobby. This total can obviously become much higher for professional musicians.

Whether you enjoy playing music in your spare time or making music is a significant part of your income, it’s important to take very good care of your instrument to keep it sounding its best.

Most musicians know that some basic upkeep is required to make sure that their instruments don’t become damaged or lose tone quality over time, but many aren’t aware of the existence of musical instrument insurance.

Can You Get Insurance on a Musical Instrument?

Just like you can purchase an insurance plan for your home, vehicle, or health, you can insure your musical instrument to protect it from theft, damage, and loss.

Musical instrument insurance is particularly important for those whose livelihood is provided by their music career, but even amateur musicians should consider insuring their instruments against an unfortunate accident or random theft.

Insurance for musical instruments isn’t only valuable for the protection of a musician’s income—it also protects instrument owners from having to pay out of pocket should something happen to their property.

A high-end musical instrument can range into the thousands or even tens of thousands of dollars, and having to replace a damaged or stolen instrument yourself could be extremely expensive.

Are Musical Instruments Covered by Homeowner’s Insurance?

Most people own at least a few personal items that are of high value, all of which should be covered by some kind of insurance plan. That’s where homeowner’s and renter’s insurance come in.

These types of insurance plans cover the house or rental property itself against multiple kinds of damage. They also cover certain items of value within the house that are explicitly claimed on the plan.

There are some items that can’t be covered by renter’s or homeowner’s insurance. These can include things like jewelry, artwork, and other collectible items. In many cases, musical instruments are also excluded due to the fact that these items have a higher likelihood of loss or damage than other personal items.

This means you’ll have to attain an insurance plan for your instrument that is separate from your home insurance in order to protect your item against theft, loss, and damage.

Is All of My Music Equipment Covered by Insurance?

The type of coverage you’ll get for your musical instrument and equipment varies greatly depending on who you get your insurance from. Different insurance companies will have policies based on the specific items they’re willing to cover and which situations they can offer reimbursement for.

Some musical instrument insurance companies only cover the instruments themselves. However, some companies cover the instrument and related accessories, such as cases, mutes, tuners, and even sheet music if these items are claimed to be crucial to a musician’s livelihood (which they often are).

Your musical instrument insurance coverage will also depend on how much your item is worth. Some companies have a maximum dollar value that they will insure when it comes to musical instruments, which means that if you have a particularly valuable instrument, your options for insurance companies may be significantly narrowed.

If you own a very rare or exotic instrument, you may have to seek out an insurance company that specializes in these types of items, as standard insurance companies may not.

Additionally, some companies offer specialized or commercial musical instrument insurance policies which can assign value to the instrument in several different ways.

These policies will usually allow policyholders to choose whether they want to get paid out for a claim that’s based on the value that the instrument holds at the time of loss or damage or a previously agreed-upon monetary value that was present at the time of purchase.

The deductibles that policyholders are responsible for will also vary from company to company and even between policies from a single company.

Before committing to musical instrument insurance, make sure that the deductible of the policy you’re considering is reasonable.

What Insurance Is Best for Amateur Musicians?

If you’re a professional musician whose instrument is directly tied to your income, a good musical instrument insurance policy is crucial to your livelihood.

However, if you’re an amateur musician who doesn’t own the most high-end instruments and music making isn’t a part of your job, you might feel slightly overwhelmed by the idea of acquiring an insurance policy for your instrument.

Luckily, there’s a middle ground between buying your musical instrument its own insurance policy and leaving your valuable device uninsured and unprotected from theft, loss, or damage.

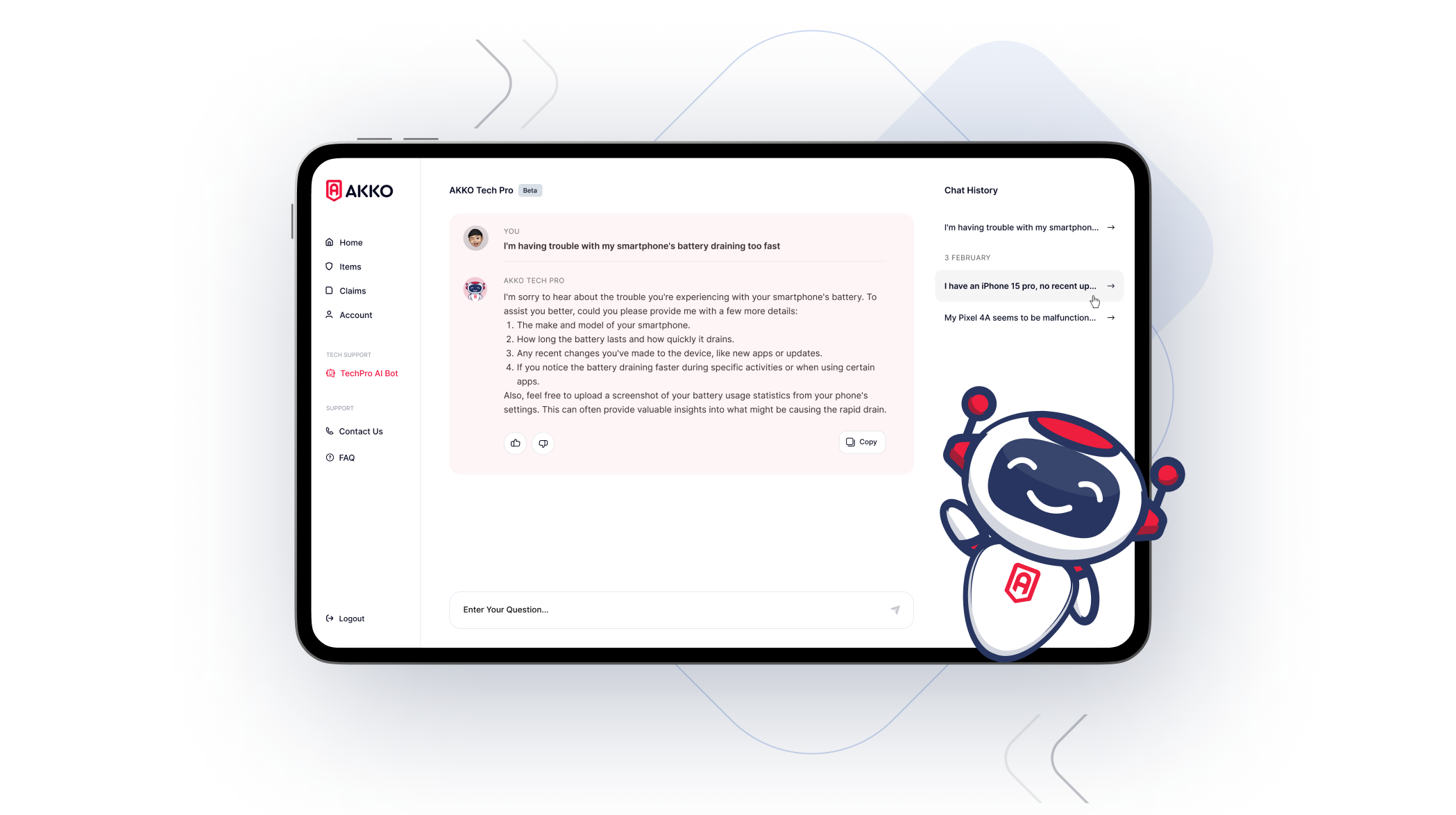

With AKKO device insurance, you can cover multiple valuable items on one plan at a single, low monthly fee.

How the AKKO “Everything Protected” Plan Benefits All Music Equipment Owners

If you own a particularly expensive or rare instrument, a specialized musical instrument insurance plan might be the best route for you to take. However, the vast majority of musicians own more standard instruments that most likely don’t require specialized coverage.

If you fall into the latter category, you can benefit from the “Everything Protected” plan from AKKO.

We know what you’re thinking: Isn’t AKKO gadget insurance designed for just that—gadgets? While it’s true that our standard protection plan was made to protect smartphones of all kinds from theft, damage, and loss at prices as low as $5 per month per line, we expanded our coverage significantly with the “Everything Protected” plan.

Starting at just $15 per month per line (and $12 per month per line for students), the “Everything Protected” plan from AKKO provides the same high level of protection for your smartphone with an added bonus: coverage for up to 25 of your valuable personal items conveniently on the same plan.

Just because your valuable items may not qualify for a homeowner’s or renter’s insurance plan doesn’t mean they aren’t worth protecting — whether these items are important to your income or are simply important to you personally.

With AKKO, you’ll also receive an extremely high level of protection for your smartphone at lower rates than many of the biggest gadget insurance providers, including AppleCare, Verizon, Geek Squad, and more.

AKKO offers some of the lowest deductibles in the gadget protection industry today. Depending on the item, deductibles within the “Everything Protected” plan range from $29 to $99 (in contrast, most gadget insurance plans charge up to $299 for a single claim).

AKKO allows unlimited claims year-round to make sure every issue with a covered item is addressed in a timely manner.

We understand that students are often working with a limited budget, which is why we make our low prices even more accessible for students. Students can access the “Everything Protected” plan for just $12 per month.

While most people covered under this plan will be responsible for a $99 deductible for claims on personal items other than their smartphones, students only pay $49.

AKKO users can also save big when they sign up for our family plans. When you bundle multiple policies on the same plan, you can access a 5% discount on each policy, whether you choose a phone-only plan or the comprehensive “Everything Protected” plan.

Best of all, bundling each member of the family on a single plan makes it easy to stay on top of your billing each month.

What Items Are Included in the “Everything Protected” Plan?

The comprehensive coverage plan from AKKO is great for both professional and amateur musicians because it covers such a wide range of items.

Whether you play a traditional musical instrument or your musical gear is more on the electronic side, you can trust that you’ll be covered by AKKO. You can even swap items in and out of your policy whenever you need to!

In addition to your smartphone, the “Everything Protected” plan covers a wide range of items like:

- Laptops, smartwatches, tablets, and TVs

- Cameras and camera accessories

- Electronic music gear, speakers, DJ equipment, and headphones

- Musical instruments

- Gaming consoles and controllers

- Skateboards, scooters, and bikes

- Clothing and accessories

- Surfboards, skis, tennis rackets, and snowboards

- Countertop home appliances

- Backpacks, textbooks, and other school supplies

Not sure whether your personal item is covered by AKKO? Give us a call or check out our FAQ for a full list of non-covered items.

Keep Your Gear Safe with AKKO Musical Instrument Insurance

Whether music is your livelihood, a casual hobby, or something in between, dealing with a damaged or stolen instrument or piece of gear can be stressful personally and financially.

With an AKKO plan, you can be sure that your smartphone (as well as 25 of your most precious items) will be protected with a high-quality plan at a price that won’t break the bank.