Most cell phone owners agree that the process of choosing insurance or a warranty for your device is much less enjoyable than testing and purchasing the phone itself. An unfortunate fact is that many cell phone users never purchase or even consider insurance or warranty for their device at all.

Protecting Your Devices

Protecting the things that are important to you is the best way to ensure that you won’t be left high and dry in the event of an emergency. That’s why health insurance, car insurance, home insurance, and many other forms of coverage are so common today.

There was a time in which cell phones were considered to be replaceable devices. But with the rise of smartphones and the fact that many people conduct their business right from their phones, keeping these precious gadgets protected is just as important as insuring your home or car.

Your cell phone insurance or warranty won’t cost nearly as much as the standard health, auto, or home insurance plan. Additionally, there are many options available for cell phone owners when it comes to protection from accidental damage, theft, and loss.

Plans from Carriers

Some cell carriers offer their own device insurance plans that clients can add to their monthly payments when they purchase a new phone. If you prefer to pay for one or two years of coverage up front instead of a monthly charge, many carriers have options for this as well.

However, many cell phone users forgo their carrier’s protection plan and opt for independent device protection companies like AKKO.

While signing up for your carrier’s cell phone insurance plan at the time of purchase might seem like the most convenient option, it’s not always financially wise! Cell phone carriers rely on the convenience factor in order to sell their insurance or warranty plans, but often only allow clients to file a single insurance claim per calendar year!

This can be extremely inconvenient if you happen to experience two common issues, like internal damage and theft, in the same year. This is extremely likely if you have a family phone plan that supports multiple devices!

New and Refurbished Devices

Plus, very few cell phone carriers provide support for used or refurbished devices because they really want customers to buy new phones. With all this — along with high deductibles when claims are approved — it’s no wonder more cell phone users are choosing to protect their devices with AKKO.

AKKO allows unlimited claims for new, used, and refurbished phones with our phone protection plans, ensuring that you’re always covered no matter what happens.

We get it—accidents happen! AKKO makes it easy and affordable to bundle multiple devices into a family plan with protection options for phones, as well as other personal devices such as laptops and smartwatches.

Now that you understand a bit more about what you can expect as a consumer when it comes to various cell phone protection options, let’s explore the concept of cell phone insurance vs. warranty coverage and what might be best for you and your devices.

What Does a Cell Phone Warranty Cover?

Cell phone warranties are designed to cover issues with the device that are inherent in the design — issues that weren’t caused by any action by the cell phone’s owner. This could mean anything from a software malfunction to a manufacturing defect that was already present when the customer purchased the phone.

Essentially, warranties cover issues that are the responsibility of the cell phone manufacturer, not the customer.

The warranty acts as a promise from the device manufacturer to the customer and their cell phone provider. It means that in the event that any software or hardware issues make themselves known, the manufacturer will either repair the issue if possible or issue a refund.

However, warranties are specifically limited to a certain period of time after purchase, usually one or two years. If any hardware or software issues are present in a new cell phone, it will likely reveal itself well within that time frame.

An Extended Warranty

Extended warranties are optional time extensions to an existing warranty agreement. This incorporates the same promise of refund, repair, or replacement from the manufacturer given in the original warranty, but extends the time period for another one to two years after the original warranty was set to expire.

Extended warranties provide phone users with an added layer of protection from internal issues that may arise during the first few years of ownership.

In most cases, extended warranties cover internal malfunctions that weren’t caught or present within the timeframe of the original warranty. This includes electrical and mechanical issues that render the phone unusable or prevent it from fulfilling its intended purpose.

Warranties and extended warranties do not cover customer damages such as drops, cracks, or spills, and loss and theft are not covered under warranties, either. For cell phone owners that are concerned about protecting their devices from everyday accidents, warranties are not the right solution.

What Does Cell Phone Insurance Cover?

Cell phone insurance is coverage that ensures that your phone will be replaced or that you will be reimbursed for the cost of repair, in the event of accidental damage, theft, vandalism, or loss.

When you seek cell phone insurance through your cell provider, like Verizon or T-Mobile, device insurance will usually only cover new phones. Some third-party providers, like AKKO, can cover used or refurbished models as long as they have functioning cell reception connected to your provider.

Cell phone insurance covers internal issues and manufacturer errors. However, they are also designed to cover damages caused by the owner or other external factors.

Most cell phone insurance companies will provide new customers with an extensive list of the specific damages they cover. Some of these fall under the umbrella term of “accidental damage from handling,” or ADH, while others fall under liquid damage or comprehensive damage coverage.

What is the Difference Between a Warranty and Insurance?

When it comes down to cell phone insurance vs. warranty coverage, there are a few key differences to consider. The first and most important is the fact that refurbished or used phones are, in most cases, no longer under warranty protection and are therefore only eligible for insurance coverage.

When you’re comparing cell phone insurance vs. warranty coverage, you’ll find that they do have some similarities. Both are designed with the intent of providing cell phone users with a layer of financial protection in the event that their phone stops working or becomes unusable.

Warranties are a form of protection that comes from the phone manufacturers, while cell phone insurance is a form of protection given by the carriers as a customer service strategy or from an independent insurance company like AKKO, AppleCare, and Geek Squad.

Additionally, payment methods are different depending on whether your cell phone has insurance or warranty coverage. While cell phone insurance is usually paid month to month along with your service bill, warranties are usually paid in a lump sum at the time of purchase.

Warranties aren’t generally available after you purchase the phone, but customers can add insurance protection at any time after purchase. They can even purchase insurance coverage after adding a refurbished phone to their plan.

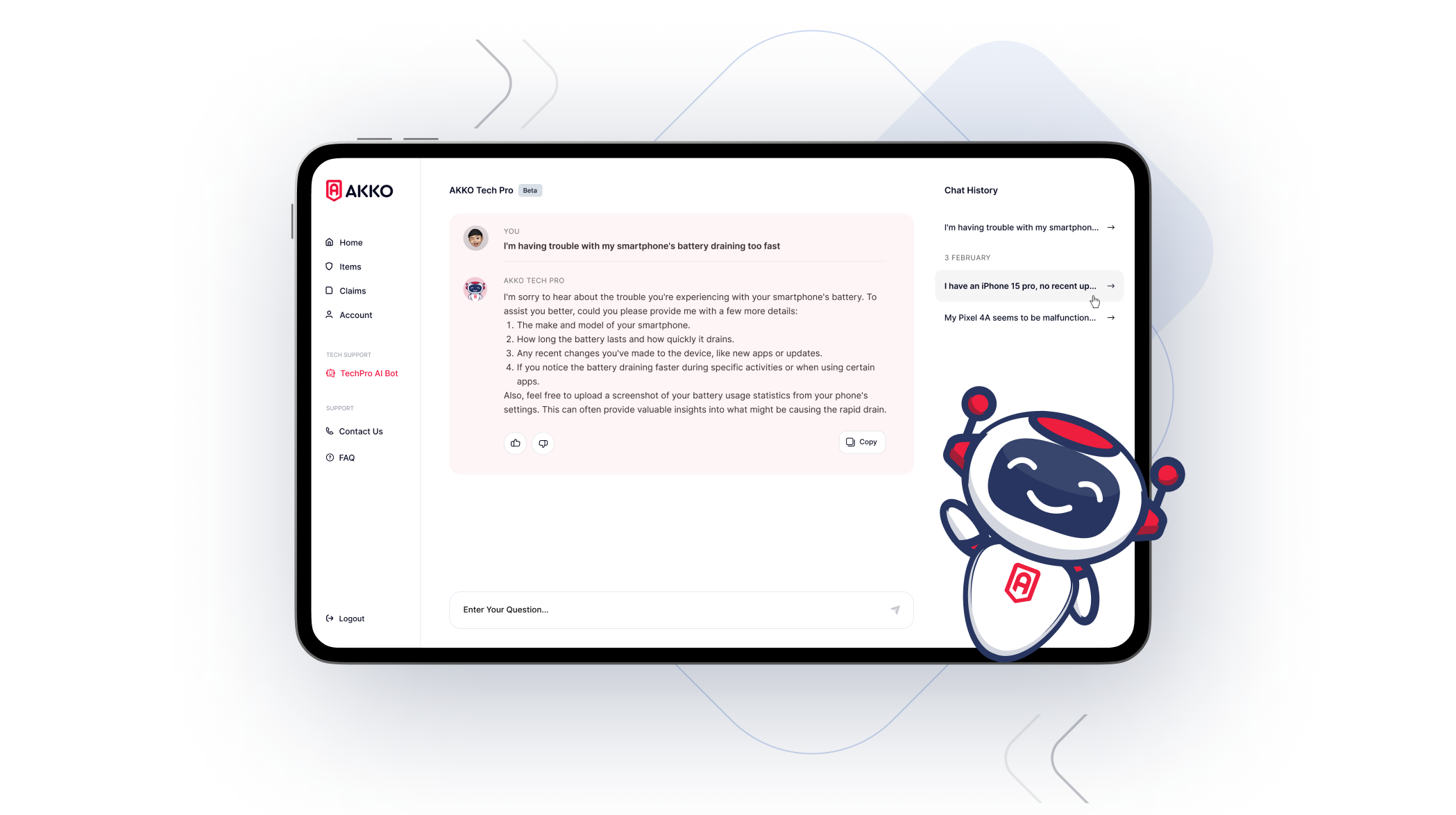

What Does the AKKO Phone Insurance Plan Cover?

AKKO phone insurance plans are the most comprehensive plans you’ll find for device coverage today. Whether your phone is brand-new from your provider or a hand-me-down from a family member, you’ll receive the same high-quality protection in the event of accidental damage, theft, or loss.

Many phone insurance providers only cover a limited range of damages, but you can rest assured that AKKO will keep you protected with expansive coverage, unlimited claims, low monthly fees, and fast turnaround times for approved claims.

Plus, families can easily bundle their coverage and save money in the process. AKKO even offers reduced rates for students (a great way to protect laptops, too)!

AKKO makes it easy to scale your coverage in accordance with your needs. If you only need basic cell phone protection, you’ll receive the great coverage our customers expect for as low as $5 per month.

Have more devices that need protection? Our Everything Protected plan includes one cell phone, plus up to 25 additional items! Acceptable items range from other electronics to valuables to clothing, all with the same low deductibles and a low monthly fee of $15!

What’s the Best Option?

You can avoid costly cell phone damage by using cases, screen protectors, and other protective products on a regular basis. However, accidents can always happen—and no number of external protectors can prevent the effects of a manufacturer error.

Does your warranty offer enough coverage to keep you protected in the event of a malfunction? You may feel much more secure knowing that your phone is protected from every possible issue with a high-quality insurance plan. If that sounds like you, sign up with AKKO today!